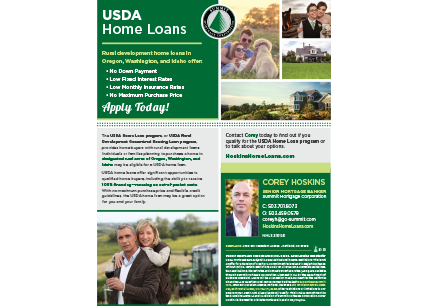

Corey Hoskins

SENIOR MORTGAGE BANKER

Hoskins Home Loans NMLS 316105

C: 503.701.8073 | O: 503.459.0579

coreyh@go-summit.com

Summit Mortgage Corporation | NMLS 3236

Licensed to originate mortgage loans in OR/WA/CA

Meet Corey Hoskins

Corey Hoskins was born and raised in Northeast Portland, Oregon. After graduating from Grant High School, he went on to earn a degree in Business Administration at the University of Oregon. Corey has been in the mortgage business since 1998. His naturally calm and inquisitive nature lends itself well to the complex world of mortgage lending. These attributes enable him to navigate each client’s needs with confidence; from the first-time home buyer to an investor in need of a strategy to grow their portfolio. Whether you have a simple question or are ready to buy or refinance a home, Corey and his team are here to assist you.

Industry Accomplishments:

- Five Star Mortgage Professional Award ~ 2017, 2018

Purchasing A Home

Your dream home is at your fingertips. Whether you’re buying a home for the first time or looking for the perfect vacation home, we’ll help find the financing option that’s right for you.

Need To Refinance?

Saving money is good. Refinancing can help you obtain a lower interest rate, leverage your home’s equity, or simply lower your monthly payments. Let’s find a refinance solution and make it happen! Capitalize on these low rates.

Niche Products

We offer a wide array of niche products, as well as mortgage loans for manufactured and modular homes, properties with large acreage, Washington State bond programs, low-interest second mortgages, future income programs, extended lock options, and more.

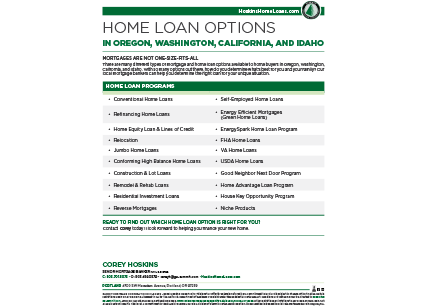

Loan Options

Purchasing or Refinancing in Oregon, Washington or California?

Look no further. I have a wealth of knowledge on a wide range of financing options. Here are just some of the home loan programs I specialize in:

- Conventional Home Loans

- Fixed & Adjustable Rate Mortgages

- Refinancing Home Loans

- Relocation

- Jumbo Home Loans

- Conforming High Balance Home Loans

- Construction & Lot Loans

- Remodel & Rehab Loans

- Residential Investment Loans

- Reverse Mortgages

- Self-Employed Home Loans

- Energy Efficient Mortgages (Green Home Loans)

- EnergySpark Home Loan Program

- FHA Home Loans

- VA Home Loans

- USDA Home Loans

- Good Neighbor Next Door Program

- Home Advantage Loan Program

- House Key Opportunity Loan Program

- Niche Products

Learn more about available loan options and apply today!

Testimonials

Corey is amazing and went above and beyond to help us in a very challenging situation.

It was a pleasure working with Corey and his team at Summit [Mortgage Corporation] I would happily recommend to others wanting to refinance.

Corey has been great through the entire process, and was very responsive. I felt the process went smoothly. Thank you!!